You can find the new feature on Maybank’s MAE app, behind the Send & Request menu. Aside from the usual send and request money buttons that let you make quick payments between users of the MAE app, there is now a DuitNow Request button. You can also send a request through the Maybank2u website under the Pay & Transfer tab.

The person you’re requesting money from with the new feature does not need to be using the same bank as you for it to work. All you need is the recipient’s registered DuitNow ID, though you can only request from those who are customers of banks that support the DuitNow Request feature. Aside from Maybank, other banks that currently support the feature include Standard Chartered & Standard Chartered Saadiq, HSBC & HSBC Amanah, OCBC & OCBC Al-Amin, Bank Islam, Bank Muamalat, and Citibank. With the pending payments, you can easily keep track of who owes how much while avoiding the awkward conversation of asking them for what they owe you. Users can have up to 20 pending requests at any given time, after which you will need those requests to be cleared before you can make another one.

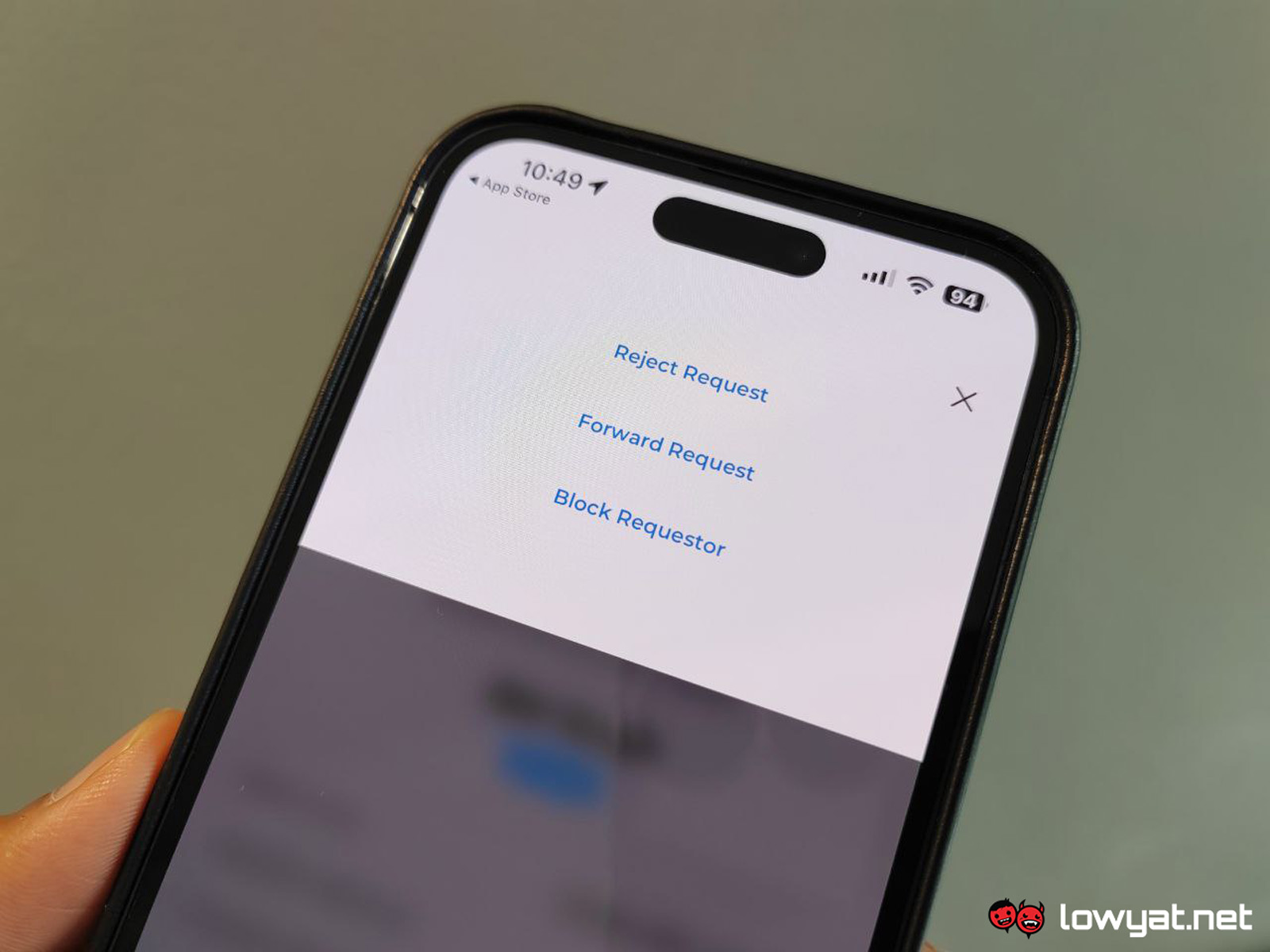

There is a transaction cap of RM50,000 per day when it comes to request fulfilment although customers can ask for up to RM10 million per request. Keep in mind that your account’s default limit for DuitNow Request payment is RM3,000, though you can change this through the Settings section of the Maybank2u website. As for fees, Maybank charges RM0.50 for every transaction of RM5,000 and above while transactions below that threshold are free. Sending requests is free of charge, regardless of the amount involved. Recipients will receive requests through MAE push notifications, email, or SMS. If you get a DuitNow Request, you can choose to pay, or, if you go into the drop-down menu, you will find options to reject, block, or even forward the request for someone else to foot the bill. (Source: Maybank, DuitNow)