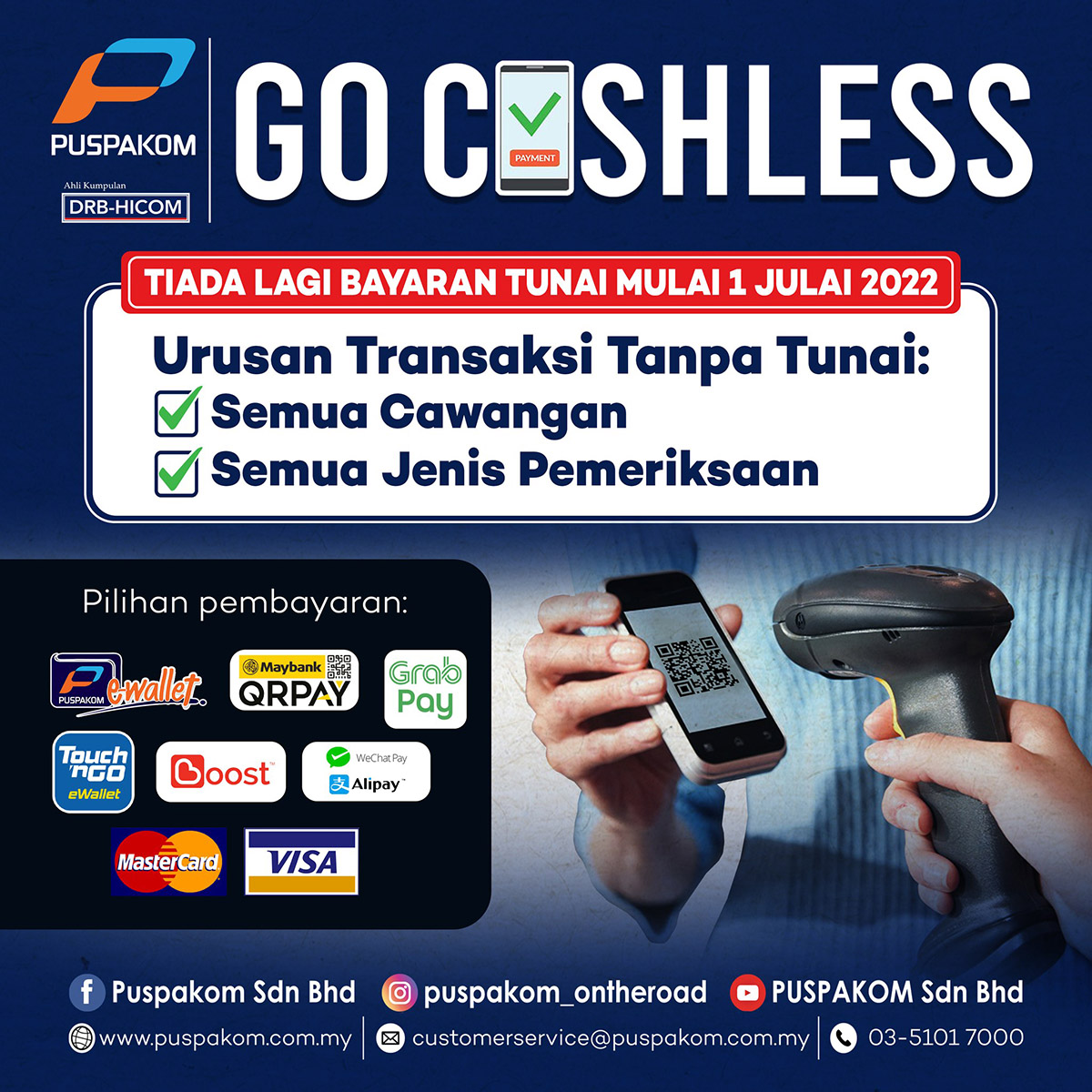

“Since April last year, cashless payments, as well as the issuance of paperless electronic inspection reports and receipts, have been implemented,” said Puspakom Sdn Bhd CEO Shukor Ismail in a statement today. “[The] data shows that more than 90 percent of Puspakom customers now use the cashless transaction method at all our branches.” Moving forward, he added that the company has decided to fully adopt the approach as it seems to be easier, faster and safer, especially in light of the current pandemic. Shukor says the implementation of cashless payments will be enforced at all 54 Puspakom checkpoints nationwide in July. In terms of supported options, he iterates that the company currently accepts online transactions from Maybank QRPay, GrabPay, Touch ‘n Go eWallet, Boost, WeChat Pay, Alipay, and its first-party Puspakom e-wallet. It is not known whether more cashless payment options will be added in the near future. For the unaware, the company first introduced its very own e-payment solution in 2019, which is accessible via the MyPuspakom Android app and website. Strangely enough, the first-party Puspakom e-wallet and mobile app are unavailable for iOS devices, therefore iPhone users are required to rely on the aforementioned alternatives for making cashless payments. In somewhat related news, all federal ministries and their departments now accept e-wallet payments for their services, as announced by the national treasury earlier this year. But unlike Puspakom, this approach is provided as an option rather than mandatory. For further information, the public can contact the Puspakom Customer Service Centre at 03-5101 7000 or its Live Chat service via www.puspakom.com.my, as well as the official Puspakom Sdn Bhd Facebook page. (Source: Puspakom [Facebook] via Bernama)